|

Navigation: <Root level> Expense Reports |

|

Expense web is a component of eFAACT Central available to users authorized users. Entry of direct and indirect expenses is controlled by the eF administrator using the QuickBooks Other Charge items. Entry of direct expenses is available to users after an Other Charge Item is associated with a direct account and lists are synchronized. Entry of indirect expenses is available to authorized users after an Other Charge Item is associated with an indirect account and lists are synchronized.

As a guide for ensuring proper recording of expense reports, eFAACT matches up a user’s selected task with the appropriate expense item, for example when user selects a direct task then only direct expense items are displayed. For indirect tasks this match up is more detailed, therefore a G&A task will display only expense item associated with a G&A account.

Expense web calculates per diem rates based on detailed location information and includes travel mileage rate for all travel types listed in GSA.gov. The source for vehicle mileage and per diem rates is GSA Travel Management (http://www.GSA.gov) .

Expense Setup:

In QuickBooks:

1. Create a vendor for each Expense Web user. QuickBooks requires a bill be entered for a vendor (not an employee), therefore a vendor must be created for each user requiring access to Expense Web. The vendor tax ID number MUST MATCH the employee’s social security number.

2. Assign the expense web vendor a Vendor Type of “ef_Expense”. This is a unique vendor type added to QuickBooks during the initial eFAACT Synchronize Lists.

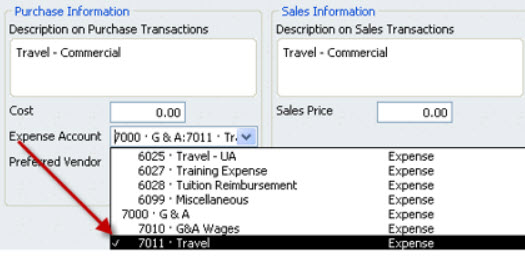

3. Create an Other Charge Item for each expense type to be entered via Expense Web. An Other Charge Item is designated as direct or indirect (G&A, OH…) based on its designated expense or COGS account. For example, when an item is assigned an account allocated in eFAACT as Direct Travel, then this item is available only to a direct job; an item assigned to an account that allocated as G&A is available only to a G&A job.

Travel features such as Per Diem and Mileage are available when the Other Charge Item is associated with a Travel account. Travel accounts are an account allocated as Direct Travel, or an account allocated as G&A or Overhead AND the account name includes one of the following phrases "Per Diem", "Travel", or "Lodging".

See below ex. of an other charge item in QuickBooks with a proper expense account that is then allocated in eFAACT Central-GL Account Allocations.

.png)

4. After vendors and other charge items are setup in QuickBooks, run an "active" eF Synchronize Lists.

5. In eFAACT Central-all users assign a company credit card for all users that use a company credit card for expenses. Once a credit card has been assigned the assigned card(s) will display as a payment option when expenses are entered via eFAACT Central.

6. eFAACT send expenses organizes each expense report in one QuickBooks vendor bill (item detail) and offsets any credit card charges with an expense tab entry. In eFAACT Central-GL Account Allocations-Account posting type section, select the expense reimbursement account you want to be used for the offsetting expense tab entry.

After an employee is setup with a QuickBooks vendor (matching TID and SSN) and at least one other charge item is created for expense web, the Expense Web menu option will be available on the user’s eFAACT Central menu.

The eF expense form walks the user through entering an expense report, prompting for the necessary information. Expense entry for a specific task is available only after the eF administrator allows access by creating the appropriate QuickBooks other charge item.

Each expense report must be approved by their supervisor before it is eligible to be sent to QuickBooks.

Copyright © Penergy Technologies, Inc.